- Politics

- Geopolitical Energy Crisis

- By Manohar Patil

Oil and Gas Prices Surge Amidst Iran-Israel War Escalation

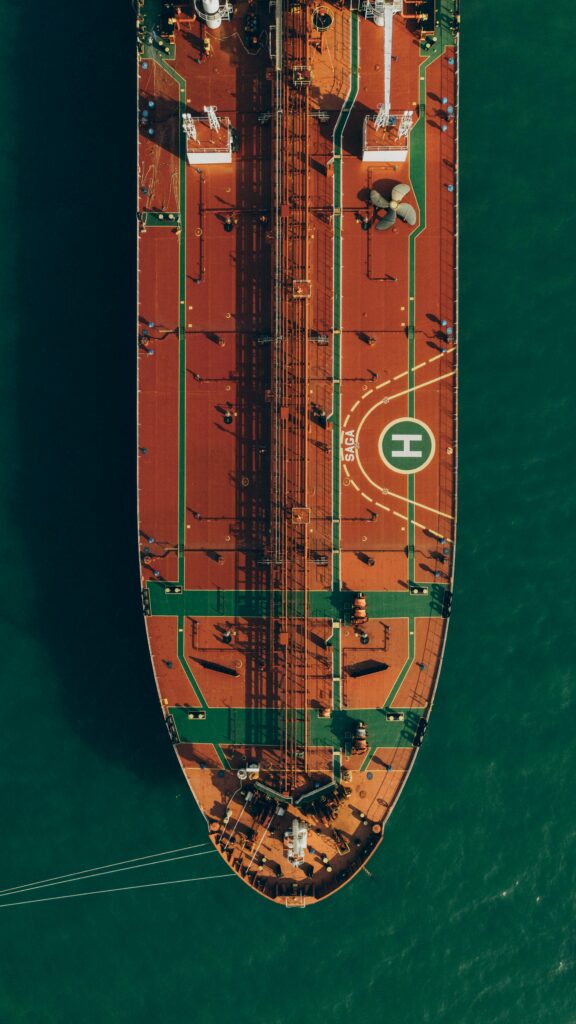

The escalating conflict between Iran and Israel has sent immediate shockwaves through global energy markets, leading to a significant uplift in oil and gas prices. This geopolitical energy crisis stems from the region’s pivotal role in global oil supply and the inherent risks of disruption to critical shipping lanes and production facilities. The very real threat of a broader conflict has ignited fears of supply shortages, driving up crude oil benchmarks like Brent and WTI, and impacting natural gas markets globally.

The Middle East's Crucial Role in Energy Supply

The Middle East is the world’s most vital oil-producing region, accounting for a significant portion of global crude supply. Countries like Saudi Arabia, Iraq, Kuwait, and the UAE, alongside Iran itself, are major exporters, and much of their oil transits through the narrow Strait of Hormuz. This chokepoint, located between Iran and Oman, handles approximately 20% of the world’s oil supply. Any threat to this waterway, whether through direct conflict, blockades, or increased shipping risks, immediately translates into higher prices due to the potential for severe supply disruptions.

Direct Impacts on Oil Prices

Following the initial Israeli strikes on Iranian facilities, Brent crude prices saw an immediate jump, rising by about $10 per barrel in a short period. While some of these initial surges might have stabilized with de-escalation signals, the underlying fear of prolonged instability keeps prices elevated. The market reacted swiftly to the increased geopolitical risk, factoring in a “geopolitical premium” – an additional cost attributed to political uncertainties. Even if direct supply disruptions haven’t materialized in large volumes, the mere threat of them, coupled with increased insurance and shipping costs for vessels traversing the region, has a direct upward influence on prices. Furthermore, any actual damage to Iranian oil infrastructure, or any retaliatory measures that impact oil production or export capabilities, could remove substantial volumes from the market, leading to even sharper price increases.

Natural Gas Not Immune to the Shock

While often associated with oil, natural gas markets are also highly sensitive to geopolitical events, especially in regions heavily reliant on imports. Although pipeline networks are more regional, the global nature of LNG trade means that disruptions in one area can trigger price fluctuations elsewhere. While the immediate direct impact on natural gas flows might be less pronounced than on oil, the overall uncertainty and the potential for spillover effects on global energy supply and demand dynamics contribute to an upward pressure on gas prices. Nations heavily dependent on Middle Eastern energy imports, such as many in Asia and Europe, are particularly vulnerable to these price hikes.

Implications for the Global Economy

The sustained uplift in oil and gas prices has far-reaching consequences for the global economy. Higher energy costs translate into increased inflation, impacting everything from transportation and manufacturing to consumer goods. This can lead to reduced consumer spending power and potentially dampen economic growth. For heavily oil-importing nations like India, the rise in crude prices exacerbates trade deficits and puts pressure on domestic inflation. Governments and central banks worldwide are closely monitoring the situation, as prolonged high energy prices could force difficult policy decisions, including potential interest rate adjustments to curb inflation. The unfolding geopolitical energy crisis underscores the fragile balance of global energy security in an increasingly interconnected world.

Share this Article

WhatsApp

LinkedIn

Telegram

Email

Get Daily Updates to Your Inbox

Subscribe to News Letter

Advertisement